At the end of 2023, Science Magazine highlighted a category of medications known as GLP-1 agonists as the scientific Breakthrough Of The Year. A result that’s unsurprising when you learn the names these medications: Ozempic, Wegovy, Mounjaro and others. And while their exact biological function is unclear, its understood that these medications curb hunger so that patients consume less calories and, thus, lose weight.

And lose weight they do, with celebrities like Elon Musk, Sharon Osbourne and Oprah Winfrey crediting their drastic body transformations to these medications.

But while everyone is so focused on losing weight, what about our cultural love-affair with eating? When food just becomes functional, and less of a deeply rooted emotional pleasure, what does that mean for the future of diners, snackers and grocery shoppers?

We spoke to individuals who have been on GLP-1s about their consumption habit changes. Here are 3 predictions for the future of snacking and groceries in the age of Ozempic:

The Consumer Story

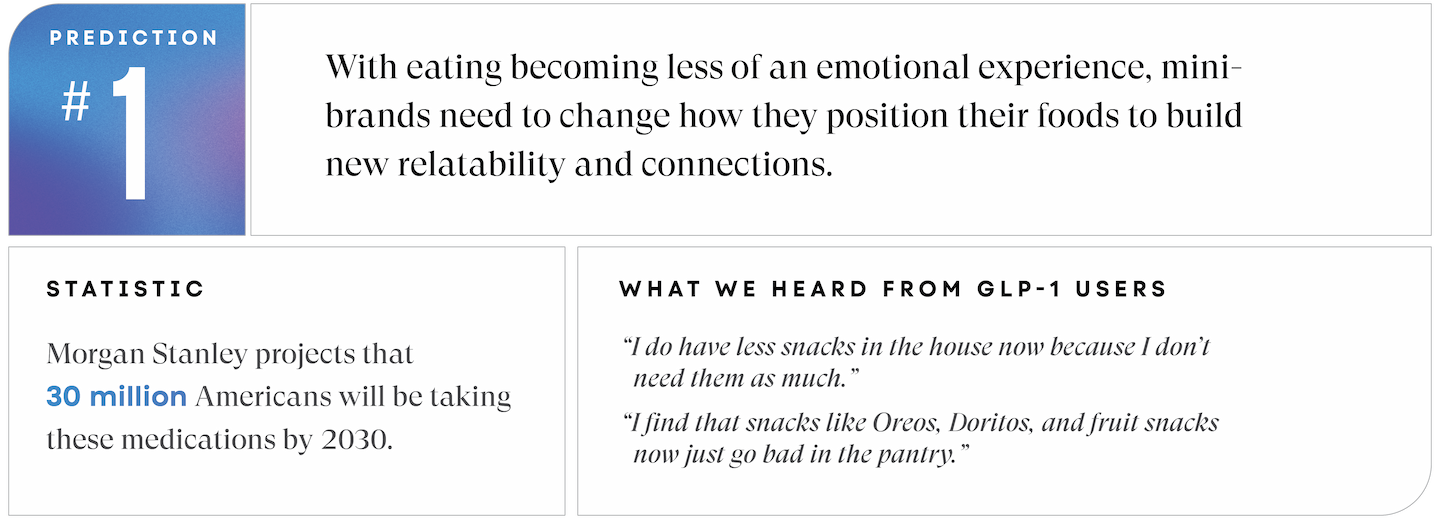

For decades, snack and food brands have leaned on indulgence, cravings, and outright gluttony to reach the mouths of consumers. From iconic slogans like “Betcha can’t eat just one” and “L’eggo my Eggo”, marketing products as irresistible and addictive has been the running playbook for food and snack brands.

But, when it comes to users of Ozempic and other GLP-1 medications, the addictive nature of certain foods is exactly what they’re treating. They confront food noise -- the thoughts, feelings, and cravings people have around food, head on. And with less food noise comes less temptation to snack, and thus less snacks purchased.

One GLP-1 user, based in Salt Lake City, noted, “When you’re on a medication like this and you go to the grocery store, you don’t just walk along and throw everything in the cart like you used to. Personally, now I mainly buy ingredients to make specific meals for my family.

”For these consumers, messaging focused on craveability and obsession won’t resonate nearly as much.

Brand Implications

To create a new emotional levers for food and snacking, some brands are leaning into a holistic change from the top-down.

In February 2024, Focus Foods, parent company for Auntie Anne’s, Cinnabon and Jamba, announced it was rebranding to GoToFoods. Per CEO Jim Holthouser, the shift to GoToFoods portrays all seven brands across the portfolio as a “family” to convey “strength” and “affection” to consumers.

Other snacking-portfolio companies are exploring changes at the individual brand level. Take Pringles, for instance, the second most popular potato chip brand in the nation. “Once You Pop, You Can’t Stop,” famously cuing the addictive nature of the chips, has been the brand’s slogan since 1996.

However, in 2022, Pringles underwent its first brand revamp, trading in their indulgence-focused slogan for anew one: “Mind Popping.” A platform that positions the snack as an eating experience sure to “blow consumer’s minds” with its packaging, unique shape, flawless stacking, taste, and heritage. This direction also serves to offer new emotional connections for GLP-1 consumers by conveying quirkiness, fun, and experience without gluttony.

As time goes by, more brands will need to make similar shifts. Whether at the holdings level, or down to the individual product, food and snack makers will need to step away from indulgence and craveability to get consumers on GLP-1 medications to buy and bite.

The Consumer Story

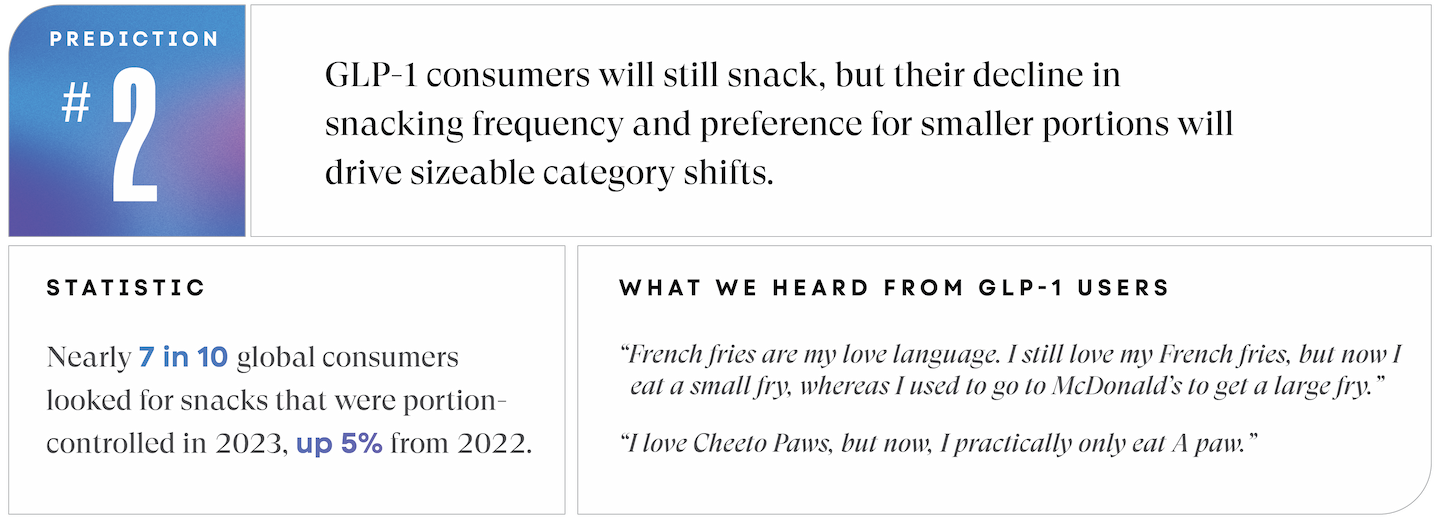

Consumers on Ozempic and related medications are not only still snacking, they also still love and adore their snacks.

Cheetos, Doritos, McDonalds fries, and chocolate-covered almonds were among the snacks named when we asked interviewees their favorite treats, a stark contrast from accounts indicating these medications lead to people only eating healthy.

But, for these same consumers, what was once a full bag of chips becomes a small handful, and what was once a twice-a-day occasion dwindles to twice a week. That means when shopping, these consumers are stepping away from bulk-sizes and opting, instead, for individually sized products. Even before Ozempic, “mindful eating” has permeated across more segments of society over the last 20 years.

One research study conducted by Georgetown University and the Natural Marketing Institute in 2022 found that 58 percent of American adults were opting for smaller portions to promote their well-being.

Similarly, the food industry has long been responding to this shift, with innovations like 100-calorie snack packs and mini soda cans being introduced to market over the last 15 years.

Brand Implications

What the rise of GLP-1 medications does present is a new level of urgency. Consumers that have already been turning their backs on family-size snack purchases will only accelerate this trend with greater adoption of weight-loss medications.

One beacon of hope is Mondelēz International, the holdings giant responsible for Chips Ahoy, Oreo, Sour Patch Kids, and other leading snack brands. Mondelēz has long been restructuring their snacks to “fit into a balanced lifestyle” and “be enjoyed in a mindful way.” The result? “Mindful Portion Snacks,” their ever-evolving portfolio of individual-pack snacks of 200 calories or less. Most recently, Mondelez announced their goal for 100 percent of their global sales to be generated by these Mindful Portion Snacks, with hopes that this transition will arm them against growing threats of healthier, more portioned eating.

In the near future, more manufacturers in the food space will have to follow suit. Pivoting will be necessary as more consumers opt for trying “get a hit” of their favorite snacks vs. the fully stocked, varied pantries of the past.

The Consumer Story

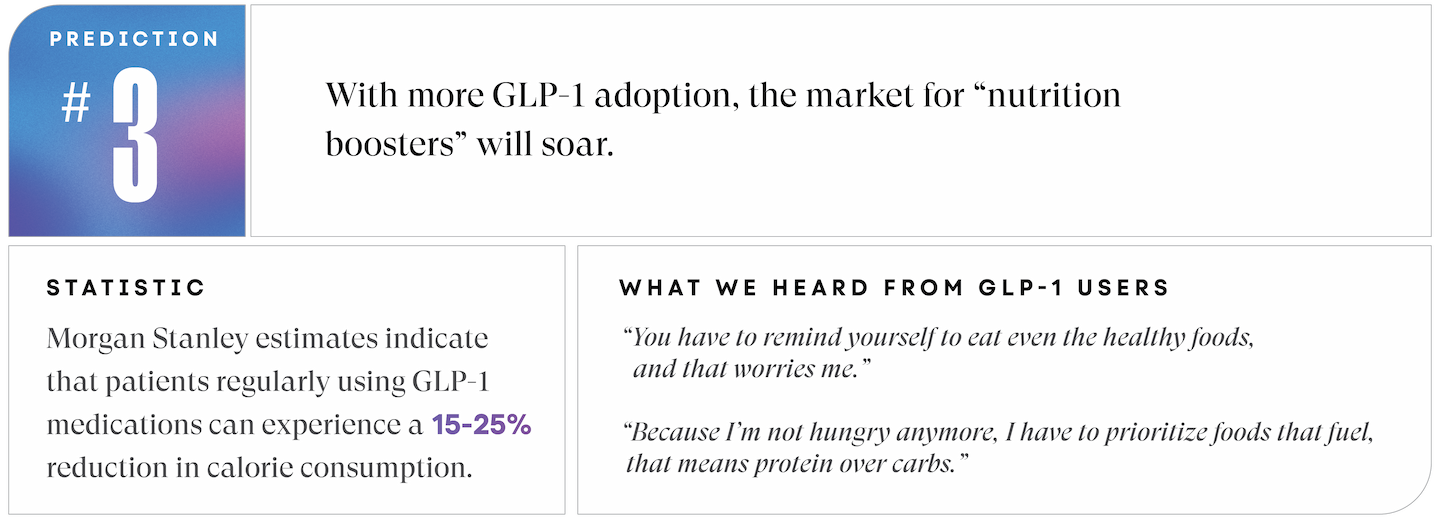

Everyone knows they are supposed to have proteins, vegetables, fibers, and all the other nutrition essentials. But what happens when they don’t?

Researchers have found that Ozempic users are at greater risk of malnourishment. This is because GLP-1 medications curb hunger and cravings against all foods.

“I’ve had a few patients and friends say they have to remind themselves to do healthy things – like eating vegetables and working out – that aren’t as fun,” one user says.

Malnourishment and malnutrition are already high in the U.S., with 92% of the population having a deficiency of some form. So, for people who take a medication that helps their body say, “I’m not hungry anymore,” this issue seems inevitable.

Brand Implications

The GLP-1 adoption curve presents an opportunity for food and supplement brands to fill this nutritional gap. We’ll see brands investing in product innovation and partnerships to take on the role of “Functional Companions”– the protein shakes, snack bars, prebiotic fibers, vitamin capsules and more that help Ozempic and other users maintain their health while losing weight. One example is Daily Harvest, a grocery delivery service that recently debuted their GLP-1 Companion Food Collection “featuring dietitian-curated meals to complement one’s weight management journey.”

We will also see players not traditionally native to the food space, like GNC and Vitamin Shoppe, having a new opportunity to play a role in these consumer’s nutritional lives.

So what?

With the rise of Ozempic and medications like it, the food and snacking industry enters a new frontier. Playbooks of the past must be reexamined, and brands will need to be agile, keeping a pulse on emerging trends and behaviors at homes, in stores, and beyond.

While the actual population is unknown, a recent Numerator survey of over 90,000 American households in January found that 12.3% had a family member using a GLP-1 medication, up from 11.4% in October. Urgency is needed. This societal evolution is not slowing down. In this Numerator survey households with GLP-1 consumers cut their grocery spending by up to 9%. Eating, America’s true favorite pastime, hasn’t undergone this radical of a change since the invention of the self-service grocery store.